Understanding the Revenue Commissioners: Role, Functions, and Significance

The Revenue Commissioners, colloquially known simply as "Revenue," are Ireland's central tax authority, responsible for the assessment and collection of taxes, customs law enforcement, and securing compliance with tax obligations. This independent powered body was instituted in 1923 within the framework of the Department of Finance and plays an intrinsic role in ensuring the country's financial well-being. The paper will discuss various aspects of the Revenue Commissioners: its historical background, structure, core functions, and its impact on the Irish economy.

Historical Background

The Revenue Commissioners were established in the aftermath of forming the Irish Free State in 1922. Thus, the milestone of the authority was to bring the collection of taxes to a full-seasoned process in a newly independent country. First of all, great efforts were invested in building an adequate and coordinated structure that would be capable of operating different taxes, and maintaining compliance with them. Throughout the years, the organization underwent quite significant transformations, Value-Added Tax, changing its methods and practices in correspondence with the urges of the social and economic life of the country.

With the economic landscape of Ireland having changed-economic transformation from an agricultural-based economy to a more diversified economy Revenue Commissioners have equally changed their approach. They have moved to adopt new technologies and methods for better facilitation of improved tax collection and compliance, which reflects the dynamic nature of these economic and social changes.

Organization and Structure

The Revenue Commissioners have three major members called Commissioners who are appointed by Ireland's Government for a tenure of approximately seven years. The organization has an operational structure supportive of its effectiveness with a general workforce comprising thousands of workers spread across different offices in the country.

Key Departments

Given the broad nature of their responsibilities, the Revenue Commissioners are organized around a number of key departments, each focused on different aspects of revenue collection and compliance.

- Personal Taxation: It encompasses income tax for individuals, usually collected through the PAYE system. Where there is no or minimal PAYE obligation, self-assessed individuals come under this category. The objective here is to help taxpayers comply while advising them about entitlements to reliefs and credits.

- Corporate Taxation: Corporate tax department, ensuring corporate compliance in relation to the corporation tax and other business-related taxes. It is an area of concern that companies pay their due share on account of taxes, important to finance public services.

- Customs and Excise: This is the body responsible for the collection of customs duties on imported goods. In this regard, the customs and Excise department lays down the platform for regulating trade and ensuring that customs laws are complied with, hence making sure that all goods coming into Ireland meet the legal standards.

- Tax Audit and Compliance: The department carries out audits to observe and ensure compliance with tax laws. It ascertains tax evasion and non-compliance, hence showing that the system leads to equitability and integrity in all manners.

- Information Technology: With the increased usage of technology for tax administration, this department maintains and upgrades the digital infrastructure to ensure that any other initiatives concerning tax collection and compliance are constantly supported.

Functions of the Revenue Commissioners

The Revenue Commissioners carry out various functions that play a significant role in ensuring financial stability for Ireland. Their importance is derived from their understanding of the economic perspective.

- Tax Collection: The main role of the Revenue Commissioners involves the collection of taxes. This entails assessment and collection in respect to various taxes, both including and limited to income tax, corporation tax, VAT, and excise duties. Effective tax collection is very crucial in financing government services and all infrastructure projects. This makes it possible for the public sector to function.

- Tax Compliance and Enforcement: One of the main functions of the Revenue Commissioners is to ensure that obligations in respect of taxes are complied with. They outline and make aware the obligation of taxes that there are, both on individual persons and companies. This agency provides necessary advice and assistance. On the other hand, they have enforcement powers to detect and investigate non-compliance and impose penalties where required. This dual function assists in ensuring fairness and equitableness within the taxation system.

- Customs and Trade Regulation: As customs authorities, the Revenue Commissioners are responsible for controlling imports and exports of goods in accordance with laws related to customs. This is very important in protecting the economy against illegal trading and further ensuring that all relevant duties are received for inclusion in the national revenue.

- Policy Development: The Revenue Commissioners have a very important role in contributing to the formulation of tax policy in Ireland. They offer the government insights, supported by analysis, for the formulation of fiscal policies that promote economic growth and stability and effective administration of the legislation on taxation. By so doing, they ensure that such legislation in the area of taxation is relevant and effective.

- Public Engagement and Education: The Commissioners of Revenue appreciate the need to reach out to the people to bring about understanding and thus compliance. They do outreach programs where information is passed on rights and responsibilities pertaining to taxes. This builds trust between the revenue authority and the people and acts to increase voluntary compliance.

Digital Transformation in Revenue Collection

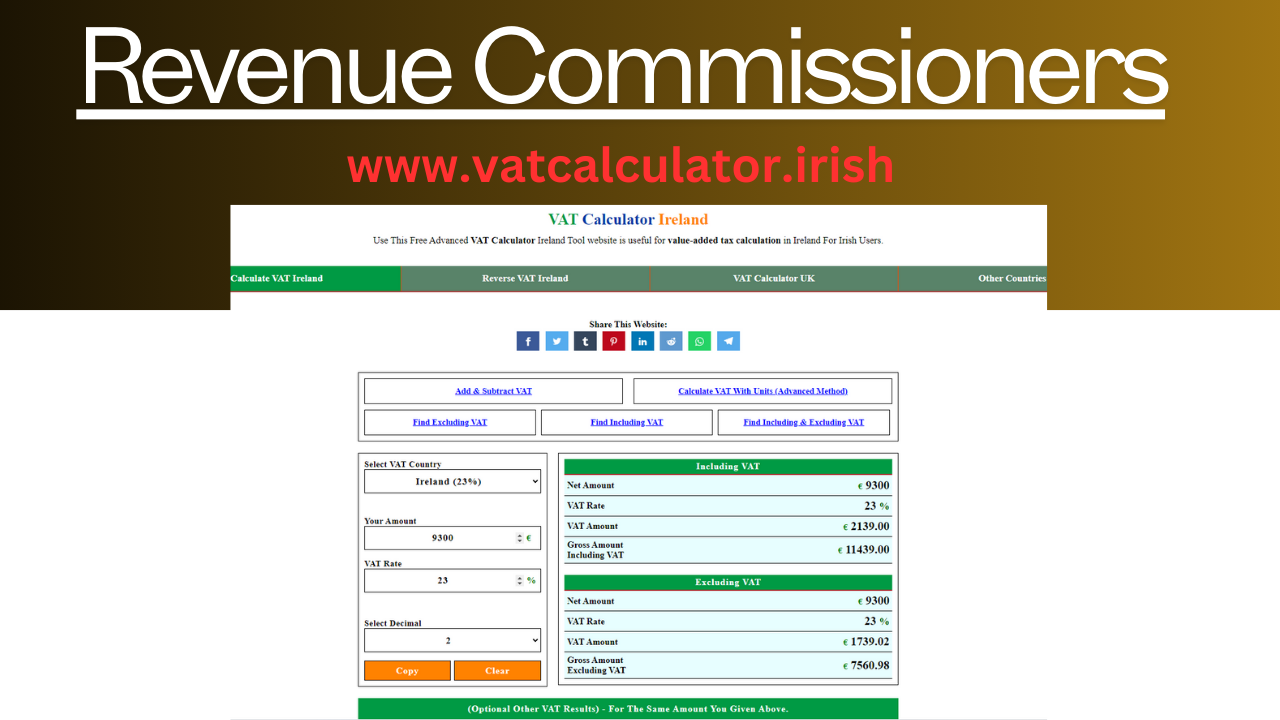

Over the years, the Revenue Commissioners have been seeking ways of improving efficiency so that the services to the taxpayers are upgraded. The introduction of online platforms has made it easier for taxpayers to file returns, pay their dues, and access necessary information with ease. It changes processes to a digital-first approach and cuts down on administrative burdens both on the authority and on the taxpayers.

Benefits of Digital Services

This move to online services has led to several dividends: more accurate submissions of tax returns, speedier processing, and access to a wealth of information online that cuts down on the need for physical visits to offices of Revenue. Similarly, automated systems can give rise to more efficient audits and compliance checks, leading to better receipts. The following issues highlight some of the problems encountered by the Revenue Commissioners.

Despite these gains, there are several challenges facing the Revenue Commissioners in the ever-changing economic world. The incidents of tax evasion and fraud have to be policed constantly and with changing tactics. More and more complex global tax regimes, mainly those related to digital economies, continuously require an adaptation in the generally accepted practice. Adaptation to changes in the economy is needed.

The Revenue Commissioners also have to respond to shifts in public attitudes towards paying taxes in response to broader economic circumstances or changes in government policy. This is a consistent balancing act between the need for revenue and demands from the public for fair taxation practices, which requires strategic foresight and public engagement.

Conclusion

The Revenue Commissioners play an indispensable role in the Irish economy. This many-faceted role encompasses the responsibilities of collecting taxes, securing observance of compliance, regulating customs, providing policy, and educating the general public. Their continued adaptation to technological advancements and ever-changing economic landscapes has them standing tall in the facilitation of a fair and effective tax system.

Irish Revenue Commissioners: A Pillar of Economic Stability

The Revenue Commissioners are nothing short of a cornerstone of economic stability within the Irish jurisdiction, a means through which the State is able to fund its essential services adequately, thus retaining the trust of the general populace. It is a reflection of this commitment to further the ever-improving scope of tax compliance and the scale of digital services in a progressive direction so that it meets the needs of Ireland's modern economy.

Consequently, it is not just a revenue authority but also an indispensable institution that contributes to the wider socio-economic development of Ireland. It strikes a proper balance between enforcement and education for building a compliance culture that is mutual between the taxpayer and the state. Its evolution will, therefore, shape the future of taxation in Ireland: fair, transparent, and efficient.